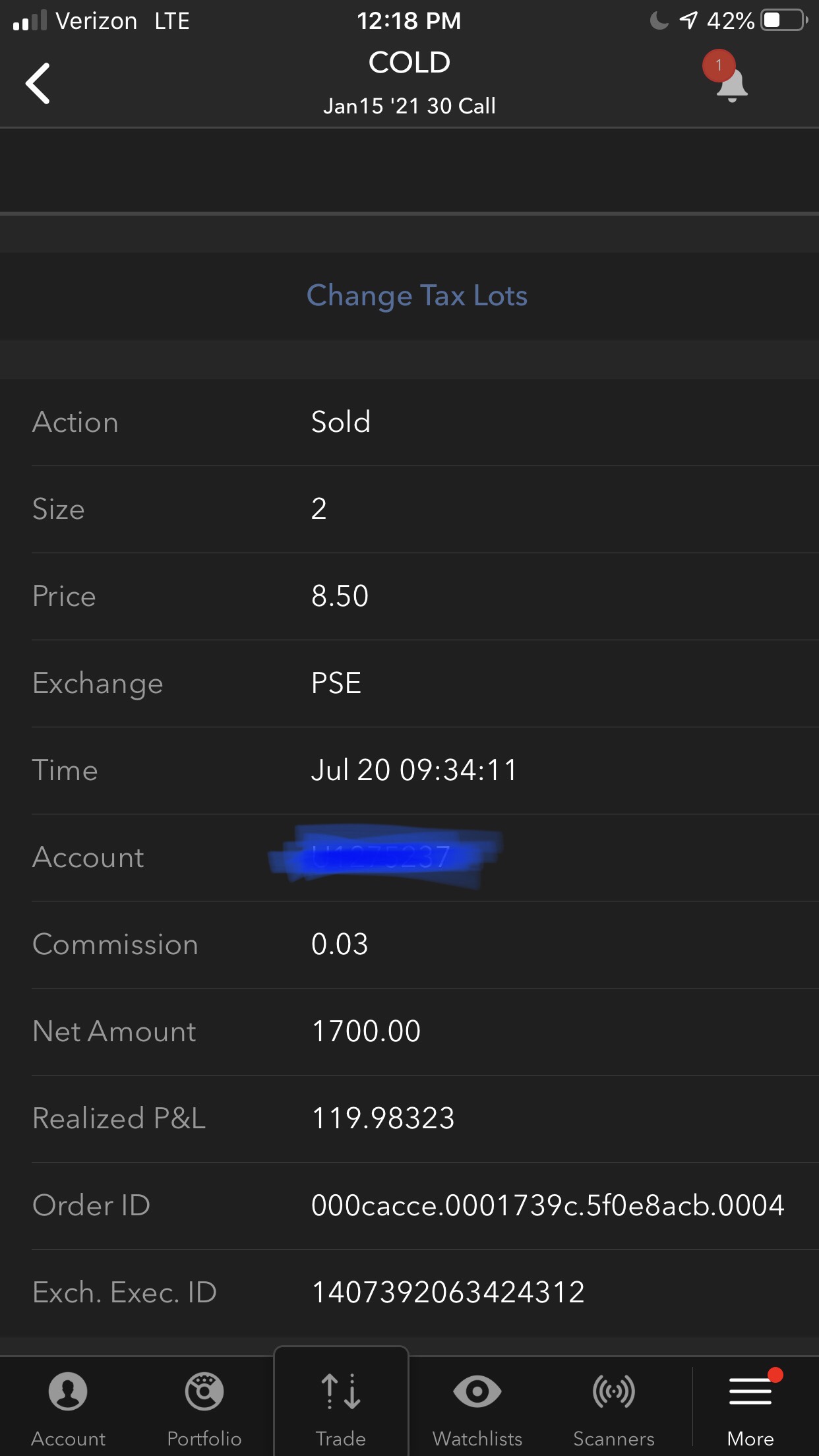

Trade Management: position CLOSED July 20th, 2020.

7/20/20: we had a significant 7.4% pullback since the high established on July 8th. On July 11th we tighten our sell order limit to $8.50 to align with our $38 initial price target in case stock popped off the 50 day MA which luckily it did. Today, July 20th, the sell limit triggered at the opening. Though there was plenty of time on the contract, within the entire portfolio we’ve been observing higher than expected volatility relative to the S&P 500 which is a signal for dialing back exposure and increasing our cash position.

7/8/20: on July 8th the position had a terrible bearish reversal that engulfed the prior 4 trading days….this triggered red flags as the stock closed on the 10 day MA – our sell signal. Prior to that point that stock was moving higher and was well above its 10 day MA which we established the 10 day MA as the sell signal in our original trade analysis below.

7/10/20: continuing to closely monitor position now that stock has retraced to 10 day MA and today it was below 10 day intraday. Stock appears to have lost the momentum it had and may begin decline. If sell off occurs looks for a pop at the 50 day MA.

Trade Learnings: This trade reinforced (1) the importance of using the 10 day MA and 50 day MA as reference points in technical analysis short-term trade management, (2) the value to establishing limit orders in advance and (3) keep a close eye on portfolio volatility and raise cash position when observed portfolio volatility is higher than expected.

TRADE ANALYSIS

Trade: Buy to Open COLD JAN 15 2021 $30 Strike Call – Qty 2 @ $7.90 per contract.

Overview: Americold is the world’s largest publicly traded REIT focused on the ownership, operation, acquisition and development of temperature-controlled warehouses. Based in Atlanta, Georgia, Americold owns and operates 183 temperature-controlled warehouses, with over 1 billion refrigerated cubic feet of storage, in the United States, Australia, New Zealand, Canada, and Argentina. Americold’s facilities are an integral component of the supply chain connecting food producers, processors, distributors and retailers to consumers.

Thesis: If you believe in the e-commerce story and rising trends in grocery delivery then a company like COLD should benefit from these long-term consumer trends.

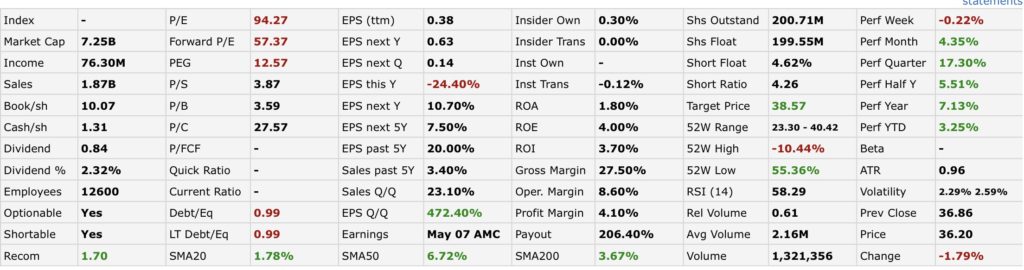

Financials: table below represents financial statements as reported by Finviz as of 6/23/20.

Price Targets: $38 per share is the initial price target slated to be achieved by 8/1/20. Secondary price target is $40 per share forecasted to be achieved by 11/1. The entry price was $36.20 so this would represent a 5.5% and 11.1% upside from the entry price, respectively.

Break-Even Price: $37.90 per share ($30 strike + $7.90 call price) which is 4.6% from the current price.

Technicals: it appears that the charts are establishing a new support trend line where prior resistance was achieved between the $34.50 – $36 range. A break below $34.50 and the velocity of the brake would indicate that we are continuing to hit resistance.

Timeframe: entered position on June 23, 2020 with a contract expiration of Jan 15, 2020. Review position with a focus on WEEKLY given the 6 month contract duration. On July 15th, 2020 you will remain in this trade if it’s still going sideways or if it shoots to the upside.

Stops / Exit Signals: you will look to begin pull the rip cord if the position goes below the 10 day MA established at entry point on 6/23 and you will certainly look to exit if the underlying stock goes below $34.50.