Trade: Buy to Open GE JAN 15 2022 $3 Strike Call – Qty 10 @ $4.45 per contract.

Overview: General Electric Company operates as a high-tech industrial company in the United States, Europe, Asia, the Americas, the Middle East, and Africa. It operates through Power, Renewable Energy, Aviation, Healthcare, and Capital segments.

Thesis: well….nobody likes GE these days. LOL so why not buy a hated asset as Buffet likes to say? Seriously though. GE is undergoing a dramatic business transformation through the shedding of its business units over the past 5 years. The impetus is their highly levered balance sheet which has significant pension liabilities. I am confident that GE management recognizes the seriousness of the situation given its decision to cut the dividen a few years back which sent the stock into its current price range along with their commitment to raise cash through these asset sales – currently GE has $40 billion in cash.

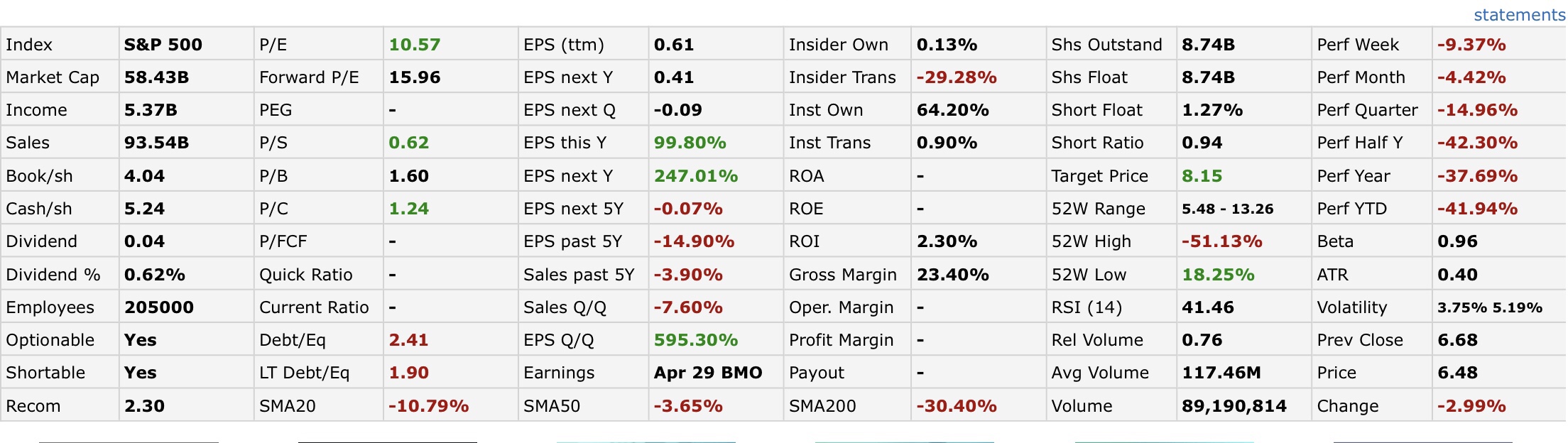

Financials: table below represents financial statements as reported by Finviz as of 6/26/20.

Price Targets: $8 per share is the initial price target slated to be achieved by 12/1/20. Secondary price target is $10 per share forecasted to be achieved by 6/1/21. The entry price was $7.47 so this would represent a 7.1% and 33.3% upside from the entry price, respectively.

Break-Even Price: $7.45 per share ($3 strike + $4.45 call price) which is 8.5% from the current price on 6/30.

Technicals: the chart is testing the long-term support trend line established back during the financial crisis at $6.40 per share. Book value per share is currently at $4.04 so a break below $5.50 would mean a material breach in the perceived value of the assets.

Timeframe: entered position on June 19, 2020 with a contract expiration of Jan 15, 2022. Review position with a focus on WEEKLY given the 18 month contract duration from the buy date.

Stops / Exit Signals: you will look to begin pull the rip cord if the position goes below $5 a share. The only way I see that occurring is a poor macro economic backdrop with COVID and/or extremely disappointing earnings where assets need to be written down and future earnings/revenue expectations are significantly guided down by GE management.

Trade Learnings: TBD